We've been watching the decline in Treasury prices and a corresponding rise in yields with growing anticipation waiting for the opportunity to catch a meaningful bounce. We think the time is here.

This piece is short on hyperbole as a picture is worth a thousand words. Let's look at some statistics to illustrate just how oversold the March 30-year Treasury Bond futures are.

First, the commercial trade side of the ledger.

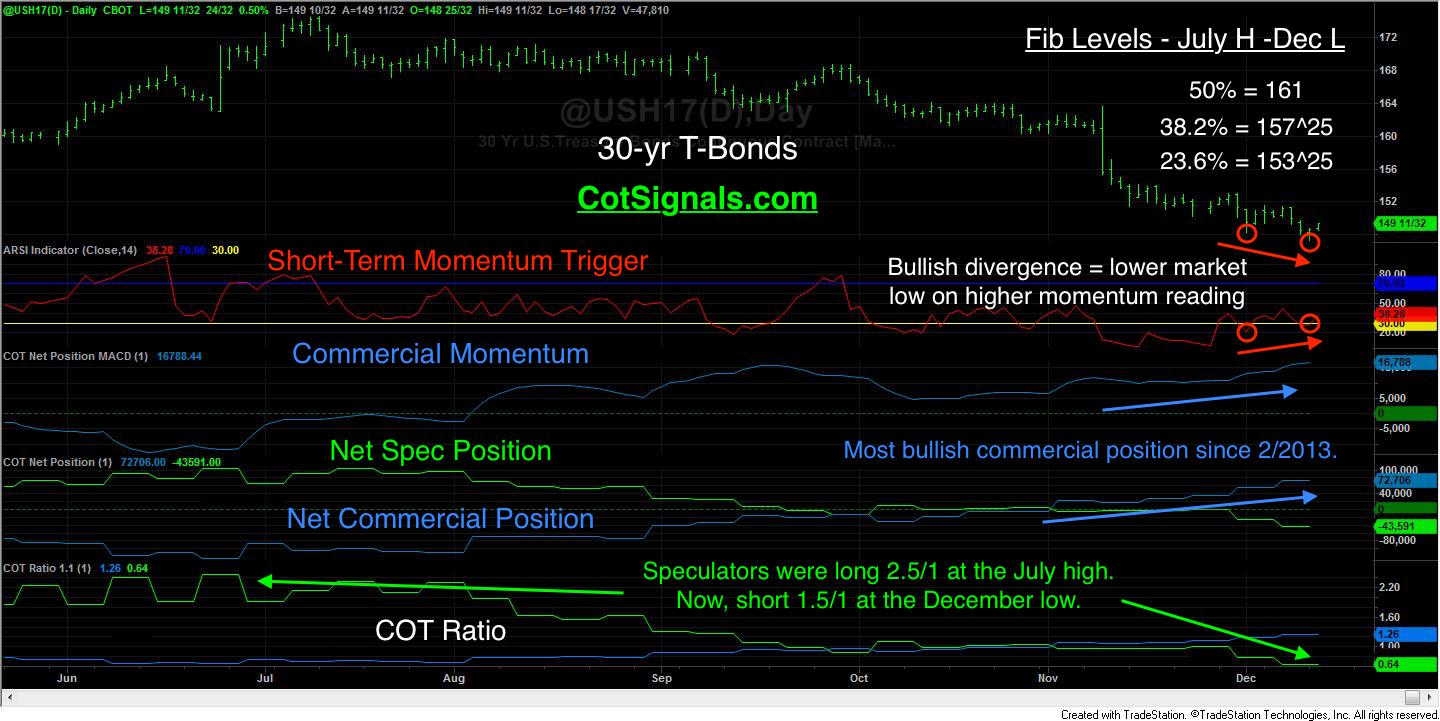

Commercial traders have built up their most bullish position since February of 2013.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) Commercial traders are now long 50% more long than they are short. This is the most bullish COT Ratio reading we've since July of 2011.

Commercial traders are now long 50% more long than they are short. This is the most bullish COT Ratio reading we've since July of 2011.

On the speculative side of the ledger, we see that they've built up their most concentrated short position since February of 2013 and their largest net short position since March of 2012. Remember that the speculators are usually wrong. They set their recent COT Ratio high two weeks before the market topped at 174.5. The concentration of their short position should give pause to new short sellers.

Secondly, the technical picture suggests a bounce is due, as well.

Our short-term market momentum indicator hasn't had a reading this low on a weekly scale since June of 2007. Furthermore, our MACD indicator, which helps indicate the bullishness of the commercial traders, is registering its highest reading since June of 2006.

We see the market as oversold and due for a bounce to test the Fibonacci retracement levels and long-term moving averages which now hang overhead as resistance. Specifically, the 120-week moving average now comes in at 153^25 in the March contract. This coincides perfectly with the first Fibonacci retracement level of 23.6%, also at 153^25.

Finally, pattern recognition paints a picture of waning downward momentum as evidenced by the bullish divergence. Yesterday's low of 147^10 set a new low for the move. However, the market's reversal contributed to a higher momentum reading on a lower low price for the move. This is a classic warning sign of a pending reversal.

We feel that the preponderance of evidence lies with the buyers in the March 30-year Treasury Bonds. We'll side with the commercial traders. Buy the market and place a protective sell stop at Monday's low of 147^10.

For more information on our Commitments of Traders analysis and how we use it to generate nightly mechanical and discretionary trading signals, please visit CotSignals.com and try our discretionary email free for one month.