There are two main points we intend to drive home. The first is that the incoming administration is pro-petroleum and steel. The second is that accurate price forecasting, and hedging by U.S. farmers is more critical now than ever.

President Trump campaigned on the slogan "Make America great again." The dialogue since his win has focused on which version of "great" he plans on bringing back. Based on the selection of Rex Tillerson for Secretary of State, Wilbur Ross for Commerce Secretary, and Rick Perry as Energy Secretary, it becomes pretty clear that NAFTA, TPP, Keystone and the Dakota Pipeline Access will be bargained for oil and steel and most likely at the expense of agriculture. This bodes poorly for farmers who've become increasingly dependent on exports to move record crops even as their incomes have declined every year since 2012.

Let's begin with the political connections, move to the economics of the situation and finally address the farmers' options for the coming crop year.

Donald Trump was a stockholder of record in Energy Transfer Partners and may still be. Energy Transfer Partners(ETP) is the company behind the Dakota Access Pipeline and the same company that appointed Rick Perry to their board after he left his Texas Governorship in 2015. He also accepted a board seat on Sunoco Logistics Partners. According to the San Antonio Express-News, Perry's compensation as a board member of the two pipeline companies as reported to the SEC was more than $450k in 2015. The fact that he landed on the boards of energy companies following his time as the governor of Texas is not a surprise. Many politicians and publicly appointed officials end up on corporate boards. Their expertise in managing relationships and navigating the regulatory waters as charted by the political system makes them invaluable in long range planning. Additionally, his compensation packages are within reasonable bounds, although he was careful to set up stock positions that won't fully vest until 2020 in those same companies and compensation packages.

Wilbur Ross, the pending Commerce Secretary, has an unbelievably interwoven corporate history. It's been flying around the news that he's divested himself of some 17 board positions already. Looking up his corporate relationships, both compensated and voluntary, on Bloomberg shows 29 current titles and positions he manages from his Texas home base. The highlights include Chairman & CEO of INVESCO Private Capital, who just reported year-end earnings of just under $1 Billion. Director and Member of the Board of Directors of ArcelorMittal, the largest steel manufacturer in the world. Certainly not last and certainly not least, he is also Chairman of the Board of Burlington Industries, a major textile manufacturer with a market cap of nearly $6 Billion. Human beings tend to offer expertise based on what they know. Wilbur Ross knows steel, banking, and textiles.

![COT Free Trial[1] copy](https://waldocktrading.com/wp-content/uploads/2016/09/COT-Free-Trial1-copy.jpg) Let's finish with Rex Tillerson, who's expected to be the new Secretary of State. Obviously, there's the Exxon link, but the scary part for farmers is that his connections on the Exxon board are all demand based when it comes to the agricultural markets. Nestle, General Mills, Procter & Gamble, Pepsi, and Wal-Mart are all directly represented on the Exxon board of directors. Each one of the companies listed will benefit from lower grain prices as inputs. Conflicts of interest could make for lively board meetings at P&G and Nestle between members John Moeller of Monsanto and Angela Bray of Exxon as well as at Nestle, where Peter Brabeck-Letmathe of Exxon and Bradley Alford of ConAgra both share seats on the board. It really is amazing how intertwined the boards of directors become at the upper echelons of corporate America.

Let's finish with Rex Tillerson, who's expected to be the new Secretary of State. Obviously, there's the Exxon link, but the scary part for farmers is that his connections on the Exxon board are all demand based when it comes to the agricultural markets. Nestle, General Mills, Procter & Gamble, Pepsi, and Wal-Mart are all directly represented on the Exxon board of directors. Each one of the companies listed will benefit from lower grain prices as inputs. Conflicts of interest could make for lively board meetings at P&G and Nestle between members John Moeller of Monsanto and Angela Bray of Exxon as well as at Nestle, where Peter Brabeck-Letmathe of Exxon and Bradley Alford of ConAgra both share seats on the board. It really is amazing how intertwined the boards of directors become at the upper echelons of corporate America.

The corporate connections only fuel combative hyperbole for so long. Eventually, facts must support the predisposition that these members acting in their corporate self-interest would propose or repeal legislation facilitating the advancement of their industries. We've reverse engineered this process beginning with our President's stance and actions on the issues noted previously prompting an in-depth background check on the makeup of his advisors whose histories and corporate connections are clearly stated public record and consistent with their actual business practices.

The short version going forward is favor oil and steel over agricultural commodities. If we were to throw a third domestic market call in the mix, we'd champion a comeback of the U.S. textile market. An examination of the Dollars and cents behind the trade values of these markets puts the bargaining situation into perspective.

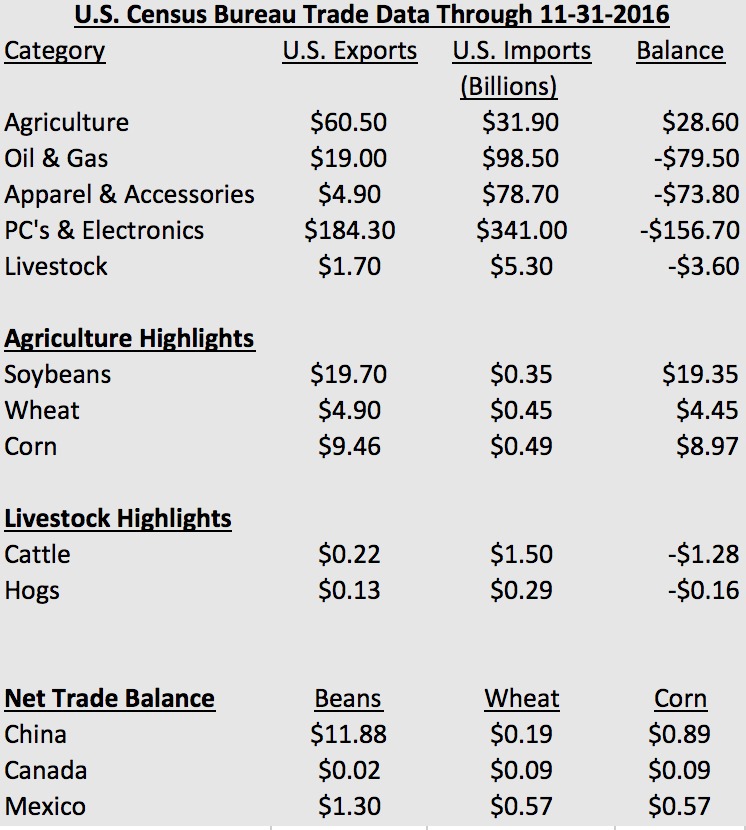

The primary problem facing U.S. farmers will be gaining the President's attention. He is most likely to focus on markets where even a small change in legislation could produce large total Dollar changes. This works even better if those same markets are ones with which his cabinet is already familiar. Considering oil & gas already runs a trade deficit of nearly $80 Billion and apparel and accessories run a deficit of nearly $74 Billion and PC's, and electronics run a larger deficit than the sum of the previous two, we believe these are the markets upon which they will focus.

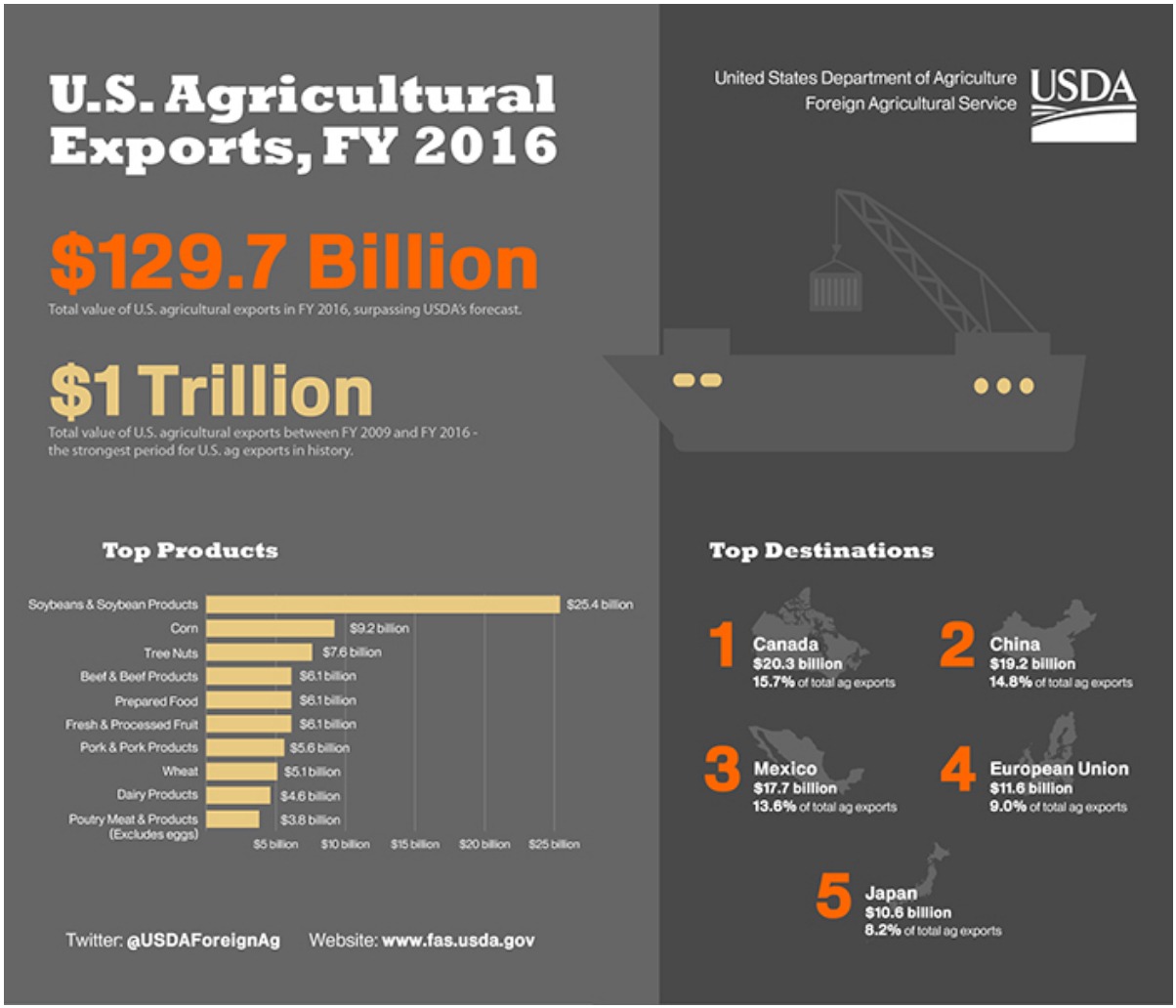

Disrupting the trade deals currently in place could quickly lead to market dislocations. The current state of the agricultural industry is based on exporting raw materials like crops to processing countries like China, Canada, and Mexico where they are processed and returned to the U.S. Consider the infographic below from the USDA's Forest and Agricultural Service.

Agricultural exports as noted above have witnessed their strongest period of growth in U.S. history. Unfortunately, economics requires us to plan for the future rather than bank on the past. The future suggests that the U.S. Dollar, interest rates, and the incoming administration may not be as friendly towards agricultural exports. The U.S. Dollar's rally since July of 2014 has just now pushed us back to the historical mid-range. However, this is the highest the Dollar has been since 2003. Notice that the USDA's graphic was for the period 2009-2016 when the average price of the Dollar was approximately 10% lower and soybean prices were near all-time highs. Distressingly for farmers, U.S. Dollar strength will be a primary tool in the balance of trade adjustments in oil & gas as well as electronics and apparel. A strong Dollar bodes poorly for farmers' increasing dependence on foreign countries' abilities to absorb consecutive years' worth of record domestic crop production.

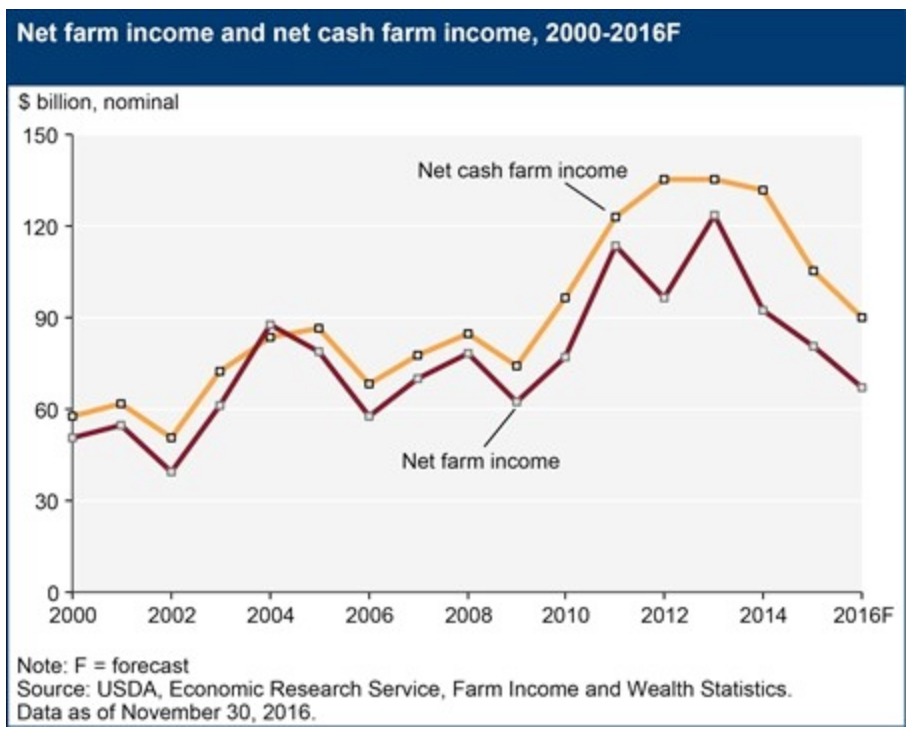

While crop prices continue to fall, interest rates will continue to rise. This means higher interest rates ahead at a time when farm income is facing four consecutive years of decline since the all-time highs from the commodity rally of 2012.

From the USDA Economic Research Service - November 30th, 2016.

"Farm sector equity is predicted to decline 3.1 percent in 2016 to $2.47 trillion, the second consecutive year of declining equity after a record $2.60 trillion in 2014. Farm sector debt is expected to rise 5.2 percent in 2016, while a 2.1-percent decline is anticipated in the market value of farm sector assets."

It's not voodoo economics or alternative facts to see that all-time high crop prices driven by global demand and grown domestically in a low-interest rate environment were keys to farmers' recent profitability.

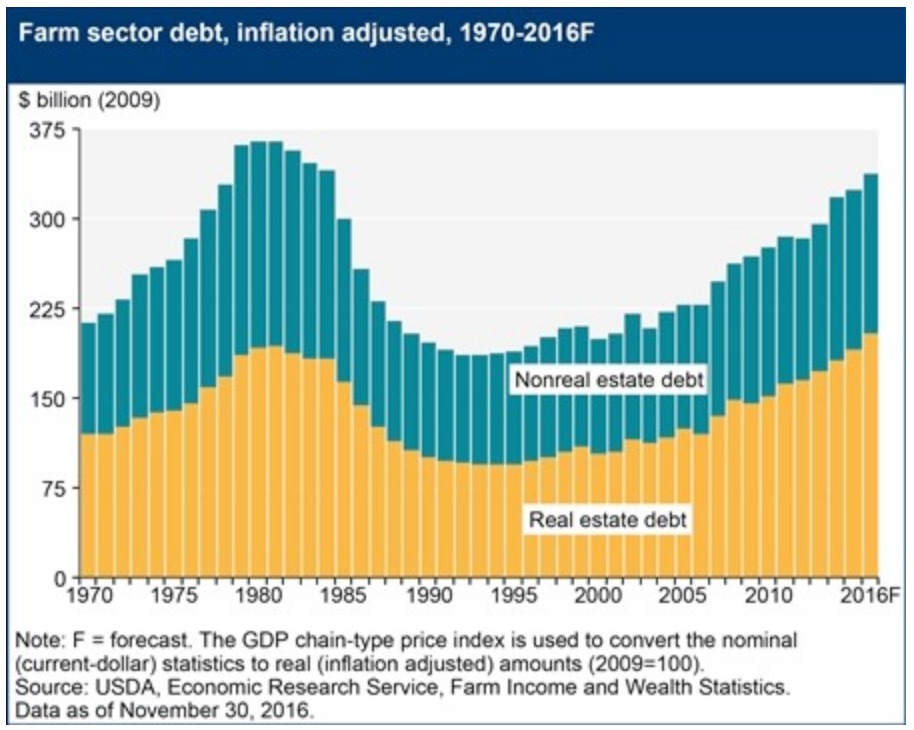

Disruption of trade agreements with our agricultural export destinations could be disastrous and could very well set up a similar situation to the boom and bust of the oil fracking environment. Fracking made the same sense with oil at $90 as buying more farmland did in the post economic collapse. Generationally low-interest rates made financing easy, and crop/oil prices remained higher than average. Furthermore, the rapidly growing Chinese demand for soybeans has created a bubble in farmland purchases leading to a second straight record year of real estate debt in both absolute terms and as a percentage of farmers' debt. The accumulation of debt to service perceived demand is very similar to the drillers' boom.

The analogy to the fracking industry continues through the coming crop year. Oil fracking continued to ramp up production even as output had nowhere to go. Producers raced each other lower as prices began to fall knowing that it was better to offload the product at a loss and remain in operation than attempt to wait it out. Mushrooming U.S. supply constricted by the 1975 Energy Policy and Conservation Act, which (still) forbids the direct exportation of raw crude, created a dream scenario for oil refiners who purchased light sweet U.S. WTI crude at a discount to global Brent crude and made a fortune selling the refined products on the global markets.

Remember Halliburton? Dick Cheney was named chairman and CEO of Halliburton in 1995. The stock traded at all-time highs more than two years from '06-'08 while Cheney was Vice President and it's up more than 18% since Trump won the election. There was hay to be made in a captive market unless you were a driller. The same will hold true for farmers. The current situation could punish crop producers while handsomely benefiting the processors like Nestle, Procter & Gamble, General Mills, and others mentioned earlier along with their coinciding chairs and directorships.

Fortunately, we can track the actions of the biggest producers, processors and even speculators through a relatively obscure weekly government report, the Commitments of Traders(COT) report. Every soybean futures account controlling more than 150 contracts (750k bushels) must file a report with the Commodity Futures Trading Commission (CFTC) that places them in one of four general categories; producers, processors, speculators, and swaps/index traders. The producers/processors are collectively referred to as the "commercial traders." They're the ones with a physical presence in the market. These are the farmers working 1,500 acres and up contracting to sell their crop at the highest possible forward prices on the producers' side versus the processors trying to buy in their forward inputs as cheaply as possible.

We've constructed the chart below to illustrate the battle between the commercial traders and the speculators. Their interaction determines the market's ebb and flows within the context of any given weather or trade related issues. Speculators have a poor track record and frequently end up with their largest position at the worst possible moment. Speculators set a new net long position record this past July. Speculators had never made a bigger bet that beans were headed higher in the history of the soybean futures market. But they didn't. Beans reversed as we all know. The reversal was primarily due to farmers' forward selling of what would turn out to be a record size crop. In fact, the farmers' total position was roughly 2.4 times the size of the speculative position. Big money takes the little money far more often than not.

The coming growing season if not longer could be challenging as farmers face threats along multiple fronts from inventory hangover, depressed prices, declining incomes, rising interest rates, and potentially destructive trade policies. Astute farmers should capitalize on the information that is available on the people determining the winners and losers in the commodity markets over the next four years and longer. Their histories are public knowledge. Their interconnectedness and actions are both easily traceable. The Commitments of Traders report is the only way to put the power of their Fortune 500 corporate analysis behind even a small farm's hedging program without having access to the same boardrooms. This year's crop is already forecasted to be large. Proper hedging can make all the difference in the world using current commodity futures contracts to protect farms as small as 20 acres of soybeans and 6 acres of corn based on 2016 yields. Don't get squeezed by trade wars. Put their actions to use and stay ahead of the game.