This walk through our Discretionary COT Signals for March 29th provides interest rate, forex, and energy examples of how we use the Commodity Futures Trading Commission's (CFTC) weekly Commitments of Traders (COT) report to swing trade the commodity markets on a daily basis. We'll make this short on text and long on practical examples.

First, a brief introduction. The COT report breaks down the commodity markets' participants into a couple of main groups. Our primary focus lies in the battle between the commercial and speculator categories. The commercial traders are those with industrial attachment to the market in question. Typically, the growers and drillers or the processors and refiners, respectively. However, this application also works in the interest rate and currency markets because the commercial traders' actions in the commodity markets are driven by their underlying business concern. Interest rate and foreign exchange risk are also tied directly to the global commodity markets.

The collective outlook of an industry's sentiment can be measured through their net and total positions. The net position tells us how bullish or, bearish they are in a given market at a given price. The faster and more extreme the movement of their net position, the more sensitive we know that industry is to the associated commodity's current price. The commercial traders' total position reflects the historical capacity of the industrial participants within the market. Ultimately, commodity markets can, though rarely, attract enough speculative interest to overrun the commercial traders' physical needs within a given market.

Without splitting hairs, we'll draw out the broad rules and show you how we use the weekly COT data in conjunction with daily data to generate swing trading opportunities in the commodity futures markets.

First, we only take trades in line with the commercial traders' momentum. Their momentum acts as our industry sentiment index. These are the collective decisions and actions of some of the most connected individuals there are. We want to put their forecasting on our side. Below we'll look at the interest rate, foreign currency and energy contracts. Consider Exxon(XOM) corporate board members' connections like Secretary of State, Rex Tillerson or Bill Weldon of JP Morgan. Nestle board member Peter Brabeck-Lemathe sits on Exxon's board, as well. Nestle has one of the most high-powered boards with former Secretary of Agriculture, Anne Veneman along with former International Monetary Fund and Swiss National Bank employee, Jean Pierre-Roth and others. The point is that there is a very small group of people that make some very big decisions pretty regularly. While we may never know the ins and outs of their reasoning, we can at least track their actions through the Commitments of Traders report.

Second, the speculative behavior is based pretty solidly on support and resistance. Speculators will drive a market from one side to the other in search of a trend and extended directional gains. Extended directional gains occur when there is a fundamental shift in the market. More often than not, markets are in sideways, non-trending action. However, this won't dissuade speculators intent on proving why "this time it's different." Once the speculators realize it's no different, they exit the market and take their losses. We model this behavior through our short-term market momentum indicator. Once there is enough speculative interest to push the market into overbought or, oversold levels, we start looking for a reversal.

Third, once the reversal occurs, it triggers the entry signal and our protective stop loss point. We always trade with protective stop loss orders covering our positions. Futures trading carries a substantial risk of loss. The newly created swing or, bottom also provides us with a mathematical risk point that we can calculate in dollars to determine whether the trade suits our risk parameter.

Finally, these are swing trades. We expect an overextended market to reverse when the commercial traders carry an opposing sense of value. The discretionary trades are supposed to generate a reversal anywhere from a few to several days long. That's it. Take the profits and run.

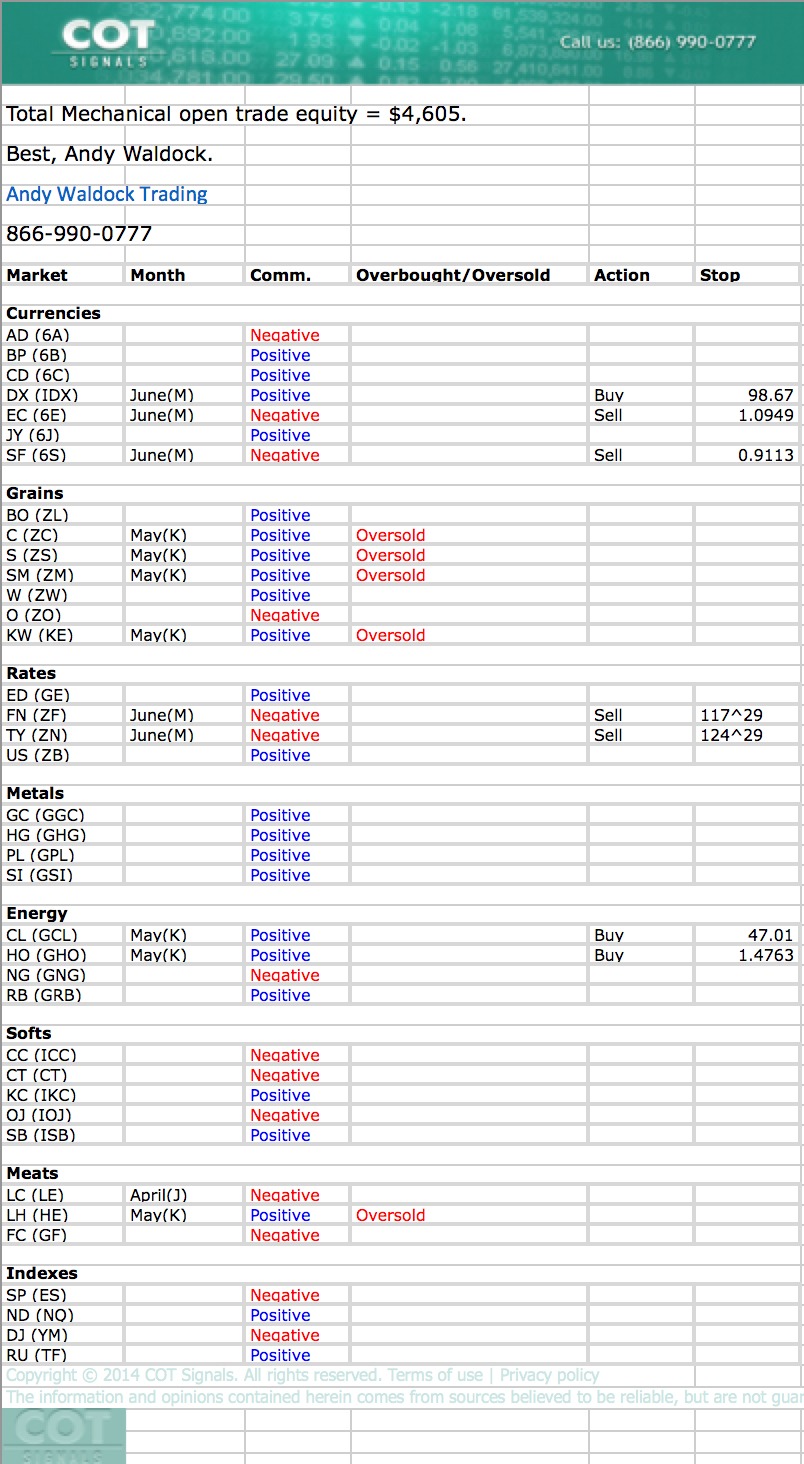

Now, onto the charts. See the full COT Signals email that went out for trading the night of the 28th, below.

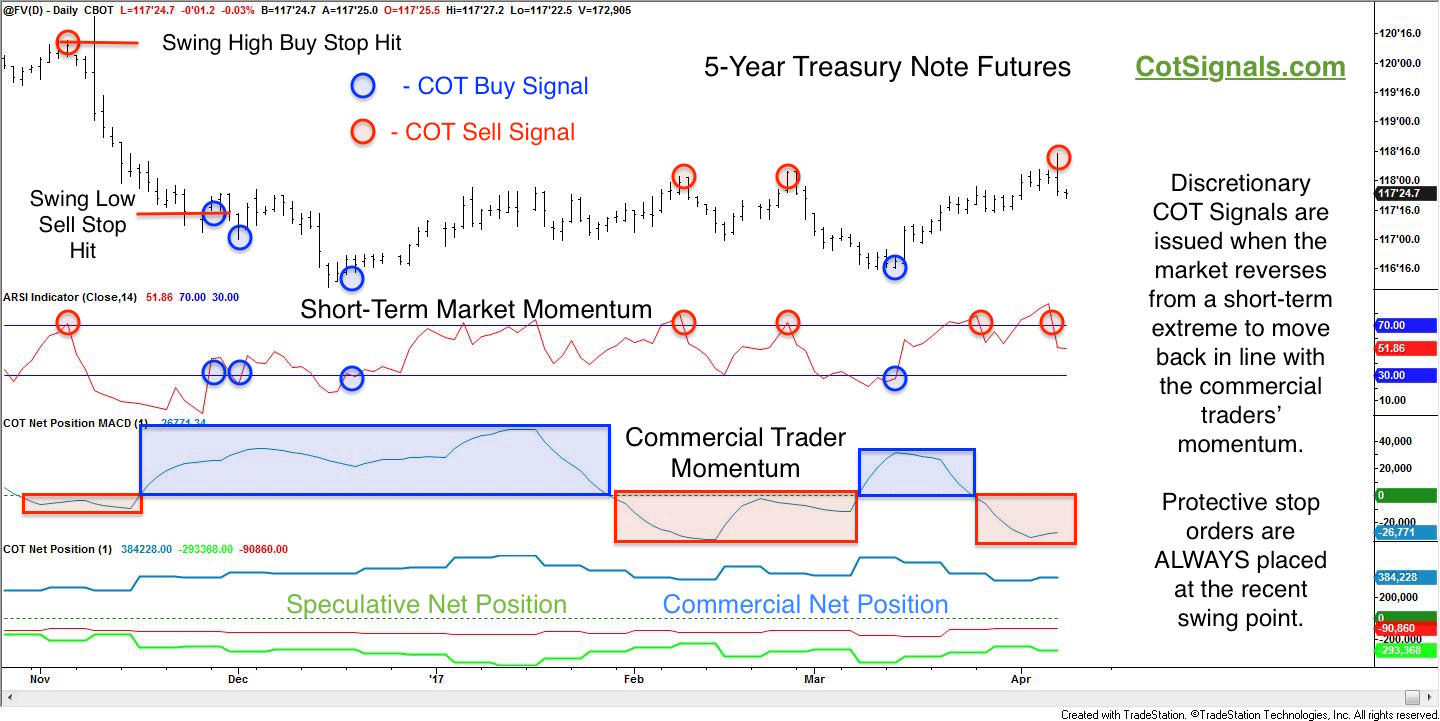

You can see that Friday, April 7th's Unemployment Report created a swing trading signal on the short side in the 5-year Treasury Notes as the commercial traders used the recent rally to unwind their record net long position.

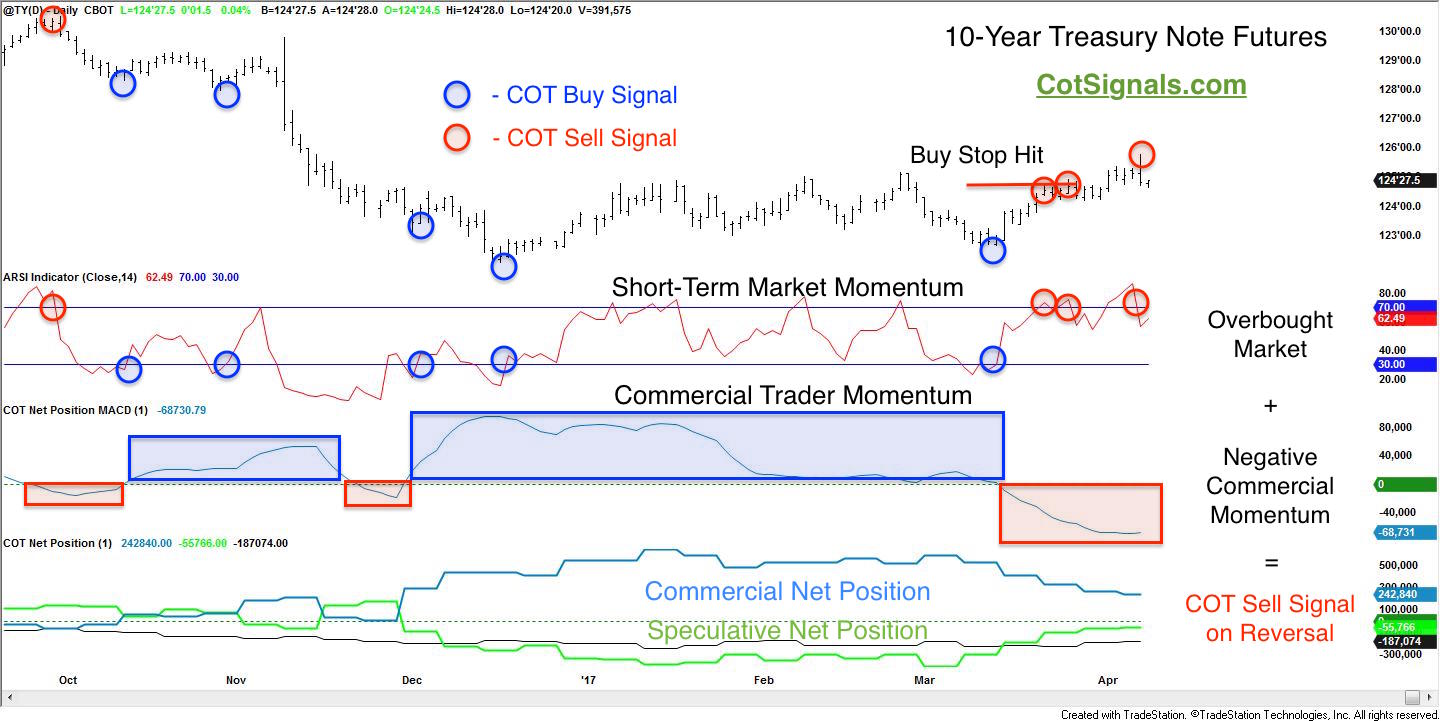

The 10-year Treasury Note futures show how consistent commercial selling over the last four weeks accelerated on the Unemployment Report and created the resistance necessary to thwart Friday's early rally. Their shift towards a negative bias ahead of the report did create two losing signals as noted in the chart above.

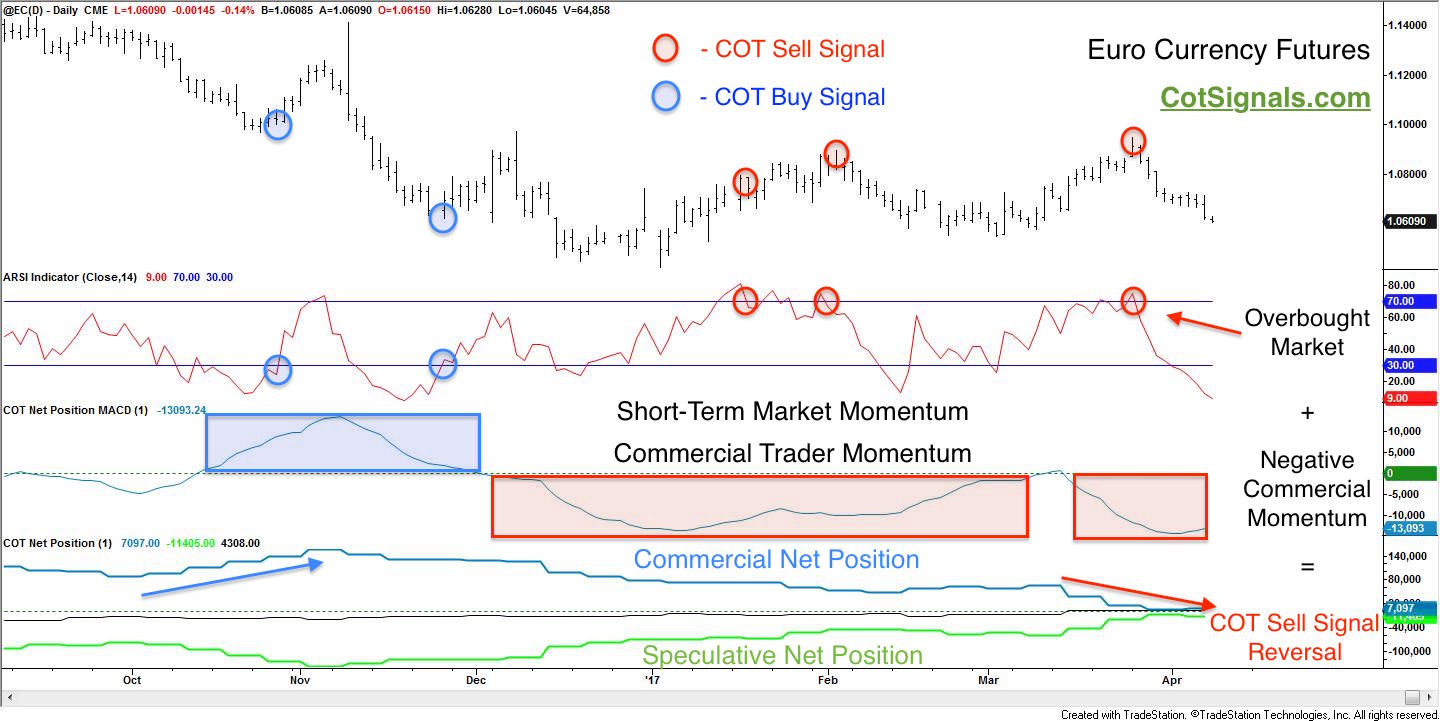

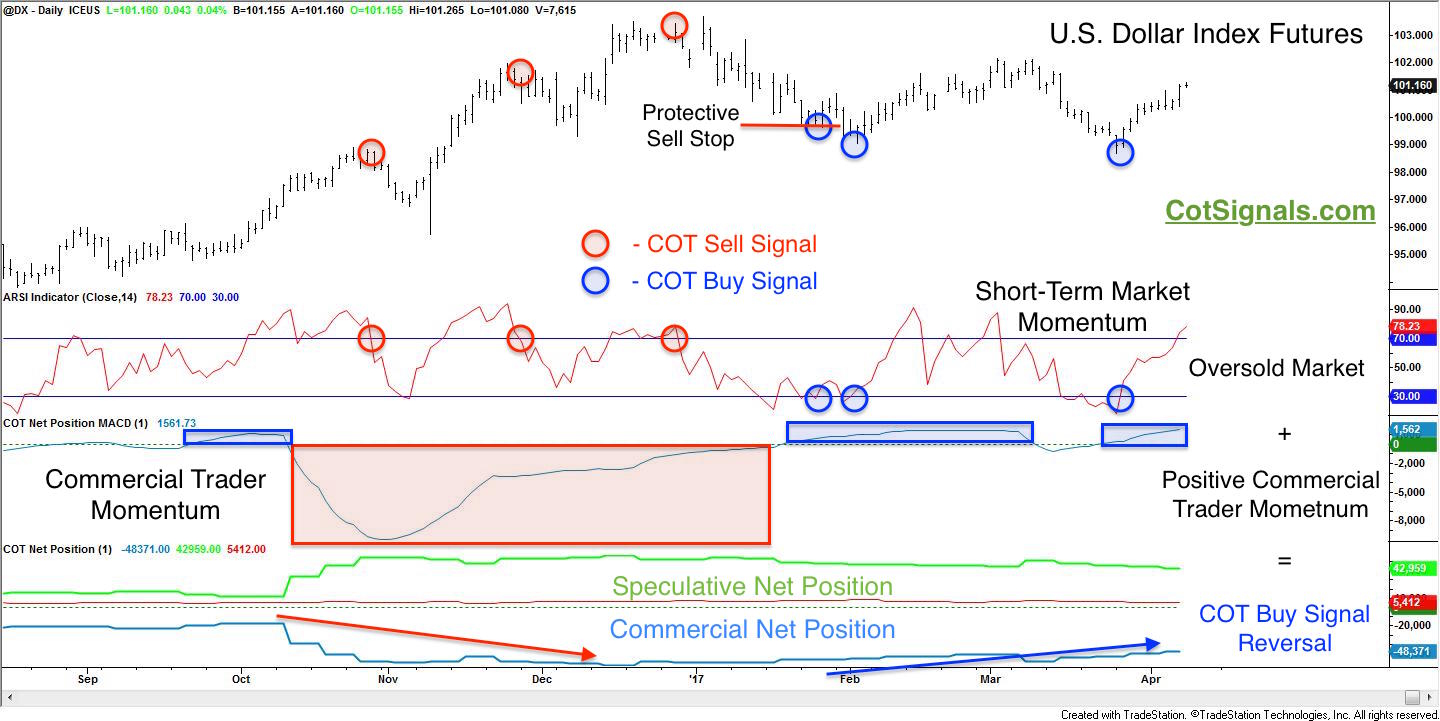

Now, backing up to the forex market, we'll look at the U.S. Dollar Index and Euro currency futures.

We'll start with another Discretionary COT Sell signal. This time, in the Euro currency.

You are probably beginning to notice a pattern between market prices and the commercial traders' actions. The commercial traders are negative feedback traders. They buy more future inputs as prices decline and sell more future output as prices rise.

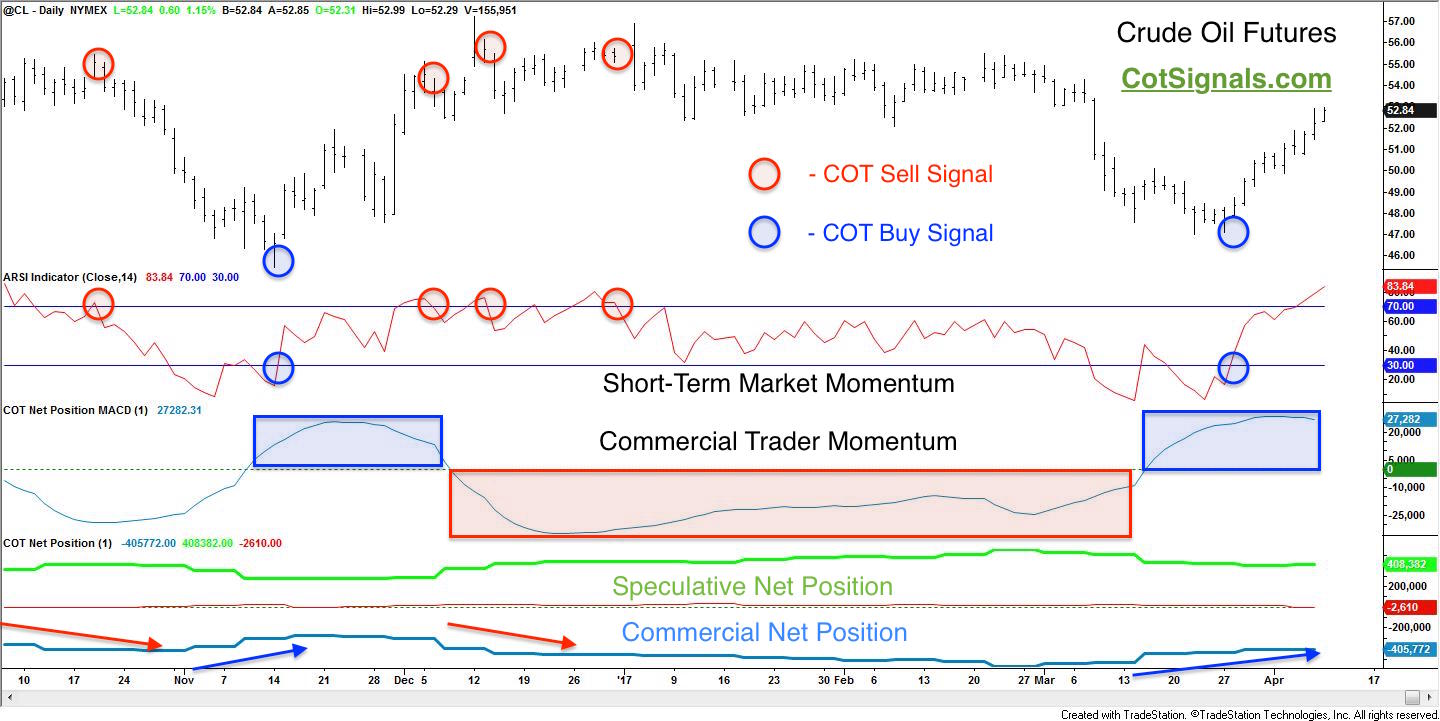

Finally, it all comes down to conflict. The bigger the conflict between the commercial and speculative traders, the bigger the pending move in the underlying commodity. Let's close with a look at the recent record position in the crude oil futures. The news outlets were trumpeting the hedge funds' collective forecast of a balanced market and record bullish position. Meanwhile, we focused on the speculative washout that we felt was necessary before crude could gain any serious upside momentum.

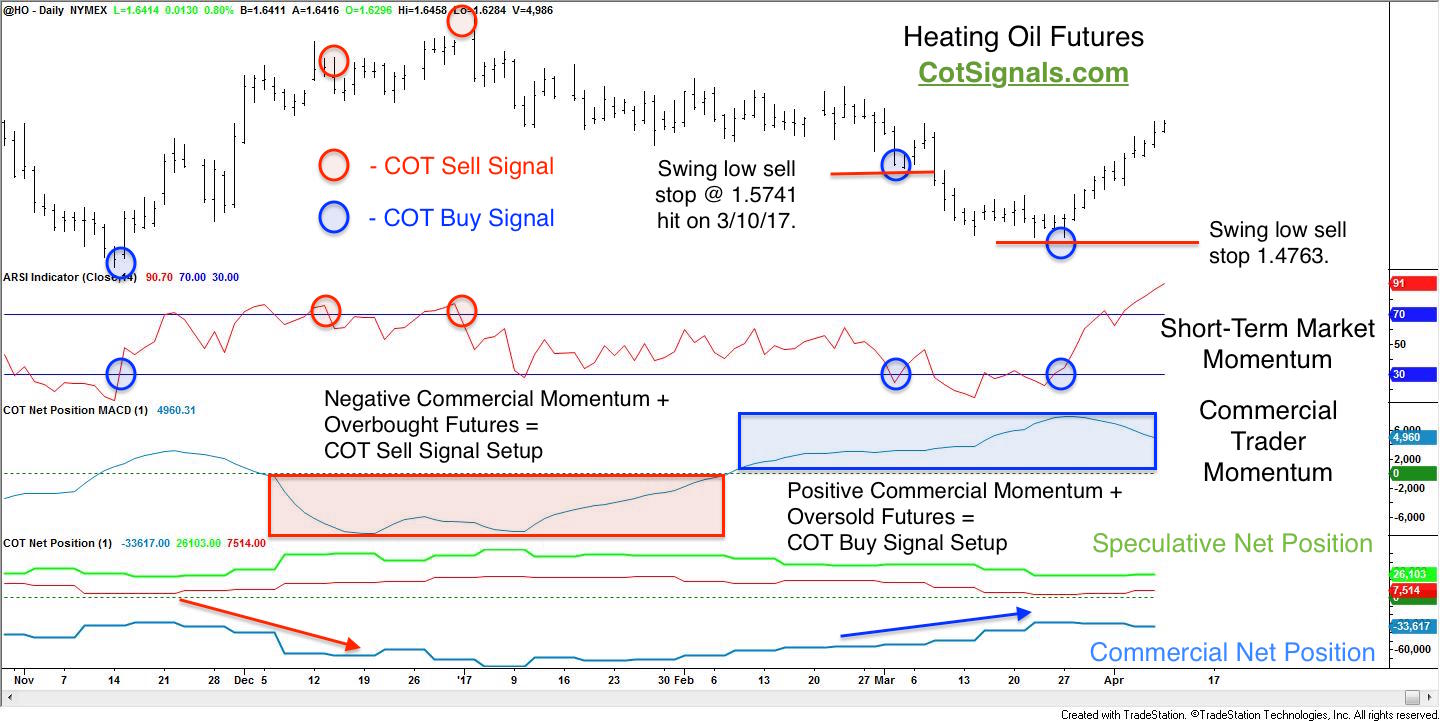

Here is the same trade in heating oil. Note also the losing trade took losses at the penultimate swing low that cued the reversal higher.

In closing, we'll briefly detail the Discretionary COT Signals worksheet that I've been keeping for nearly 16 years. The first two columns are self explanatory. The third one is commercial momentum. Remember, we only take trades in line with the commercial traders' momentum. The fourth column is the setup. This is the overbought or, oversold reading, which will always be the opposite of commercial trader momentum. When the fourth column is lit up, we know there's tension within that market and that it is ripe for reversal. However, we don't take action until the market reverses to move back in line with the commercial traders' momentum. Remember that the reversal also provides us with the protective stop price. This brings up two key rules in trading. First, never try to pick tops and bottoms, wait for some type of reversal. Second, never trade without knowing and adhering to your risk levels. The action column will always signal the buy or sell in the same direction as the commercial traders' momentum while the stop column provides the price for the position's opposing protective stop loss order.

We offer both discretionary and purely mechanical versions of these signals written in Tradestation. Please visit, CotSignals to sign up and put the resources of the world's biggest companies and most connected minds behind your trades.