Our two primary trading screens are based on the Commitment of Traders report and commodity market seasonality. Both of these are currently supporting the Australian Dollar.

January 8th update - Position closed for profit of $2,030.

The Commitment of Traders(COT) report tracks the positions held by both the speculators and the commercial traders. The conflict between these two trading groups is the primary focus of our monthly column for Modern Trader Magazine. The commercial traders are the ones with a fundamental hand in the commodity's production or, consumption. The speculators are just what their name implies. Our thesis is that the commercial traders are usually right. While they may not win every battle, they win most of the wars. The bigger the conflict between these two groups the uglier it usually ends for the speculators.

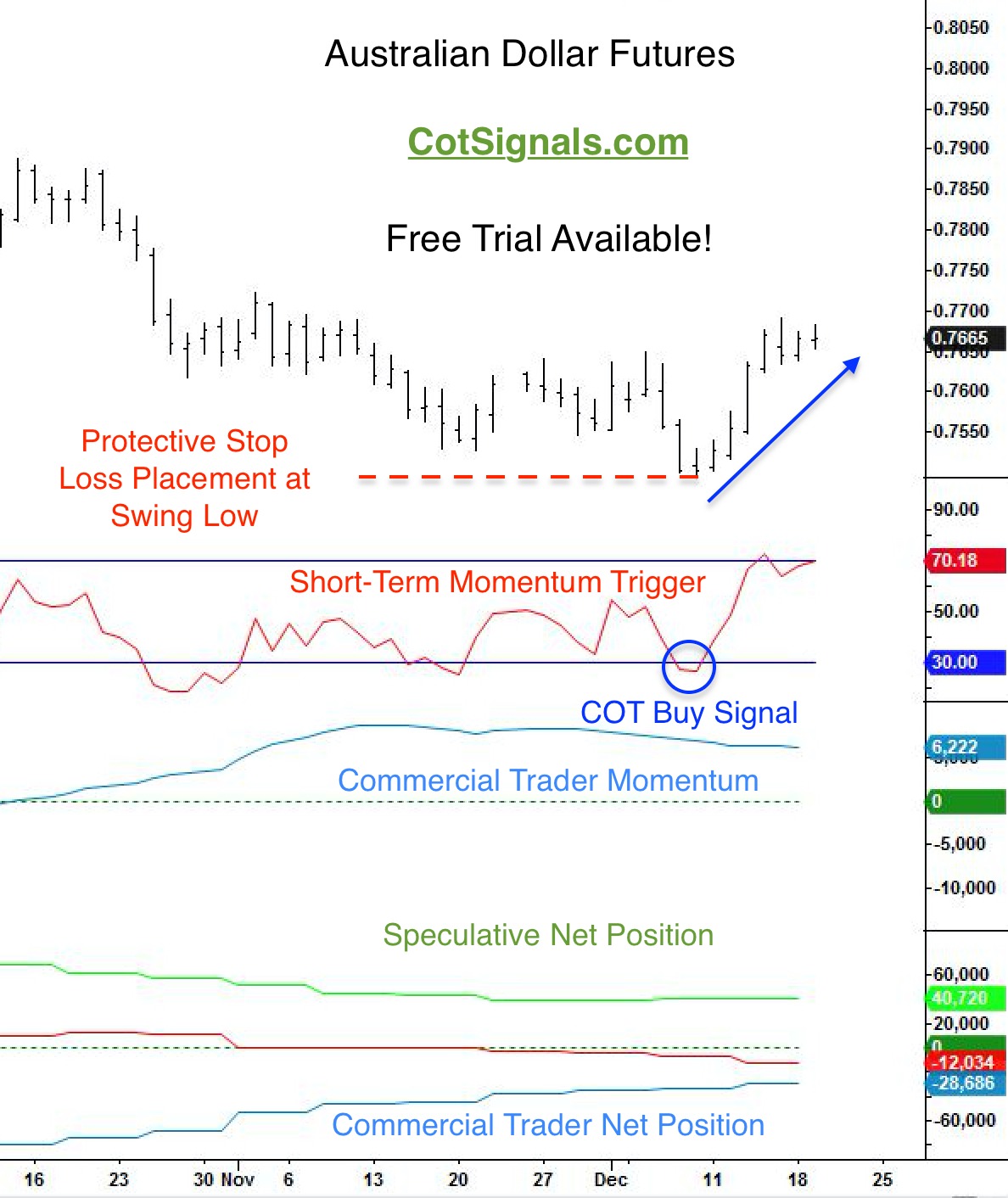

We published an Australian Dollar discretionary COT buy signal on Monday, December 11th. The buy signal is based on trend following, speculative selling trying to press the Australian Dollar to new lows in the face of commercial support. Looking at the chart below, you'll see that the commercial traders began buying in the beginning of October. Commercials have now been net buyers for 11 straight weeks. This has pushed commercial trader momentum well into positive territory. Therefore, when our short-term momentum trigger became oversold, the trigger was set. Once the market climbed back above oversold, we issued the buy signal in line with the commercial traders' momentum. The speculators have been covering their short positions ever since. Let's look at the setup, below.

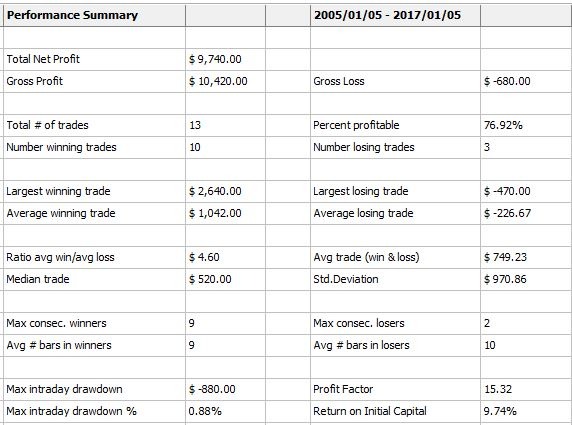

Our Discretionary COT Signals subscribers got a one week jump on the forecasted strength of our seasonal analysis, which went out last night. Our seasonal model has forecasted a period of strength for this year beginning last night and lasting through the first week of January. We run these models a few different ways to build a composite actionable trading plan. First, we'll provide a generic performance report, similar to what you'll find on any trading application.

*Past performance is no guarantee of future performance.

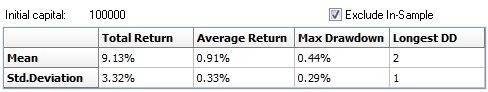

These are easy to read and provide valuable information. However, deeper metrics allow us to rip the string of trades apart and stitch them back together in random fashion. The more times we do this, the more likely we are to account for good results based on a given slice of time and price data. In other words, it helps eliminate curve fitting and validates the model's prognostication abilities. Let's look at the Monte Carlo analysis.

*Past performance is no guarantee of future profits.

The most important metric in this chart is the Average Return column. Successful trading is all about the adage of cutting losses short and letting winners run. The Average Return column tells us that we can expect a winner around $910 at the mean. Meanwhile, the Standard Deviation of these returns is approximately one-third of the average. This tells us that performance has been relatively consistent because the spread between the mean and the standard deviation is rather large. This also means that a trade in the third standard deviation to the downside may still be profitable. This is one of the ways we quantify the risk/reward equation.

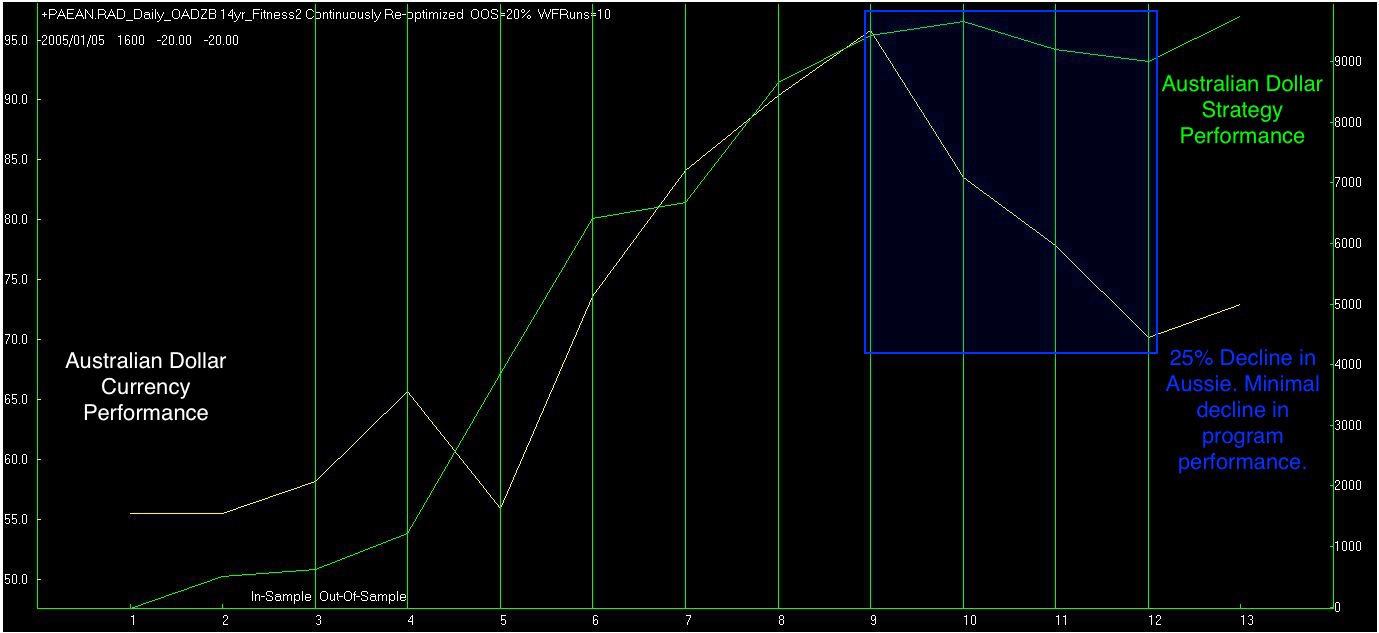

Finally, let's look at the correlation between our seasonal analysis and the Australian Dollar's performance. This will explain the importance of de-trending the input signal.

*Past performance is no guarantee of future profits.

The Australian Dollar was in a protracted downward trend through trade numbers nine through twelve. While the underlying instrument lost nearly 25% of its value, the seasonal trading program remained fairly stable, despite losing two out of three trades during this period.

Trading is a lot of hard work. It wasn't easy when we kept charts by hand, and it's not any easier using today's technology. We continue to evolve by stacking the odds in our favor. The one-two punch of the commercial traders' support and structural seasonal support is a good start in that direction.

1/2/2018 Update: The Australian Dollar has continued to rally and is trading around .7830 as of this writing.

*Past performance is no guarantee of future performance.

Visit CotSignals.com for more information on our trading methods as well as a free trial to our Discretionary CotSignals featured, above.