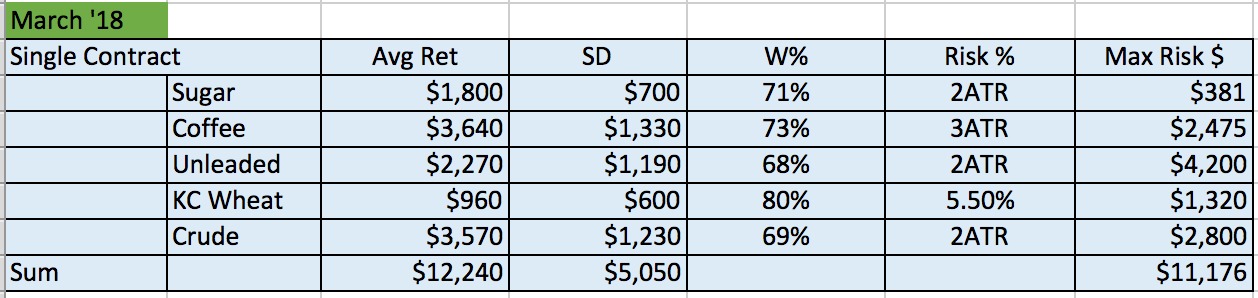

We have five trades we're expecting to trigger based on our seasonal analysis. We'll be trading sugar, coffee, RBOB unleaded, Kansas City wheat, and WTI crude oil, respectively.

First, let me bring you up to speed on our performance, thus far. We've closed 19 trades and won about 58% of them. Our biggest winner has been $4,390. We expect this to increase as we're currently carrying more than $7k in open position profits in the Dow futures, which we plan to offset by the end of the week. Our net profit for the closed trades is just over $14k. We're still carrying the previously mentioned Dow futures and silver as open positions but, we expect to close the silver trade this evening for a small profit.

Finally, before we get to this month's expectations, I'd like to clarify two points of operation. Our models are based on entering the market one day and placing the protective stop beginning the following day. This does leave positions uncovered on the day of entry. Secondly, I've decided that I'll publish one model for each trade. I know there was confusion in the crude oil trade between the static stop vs. the volatility-based stop loss order that we updated nightly. The benefit to you, the end-user is that you'll get the model and trade that I'm putting to work in my trading. Therefore, some will be dynamic and require nightly updating of the protective stop-loss order and some will be static, requiring only a single placement. Either way, I'll let you know which model we are using as well as the appropriate risk parameters prior to the trade's entry.

I measure volatility using the Welles Wilder "average true range," approach. This calculation method takes opening gaps into account when measuring short-term market volatility. Average true ranges will be expressed as ATR. The risk is tabulated as a multiple of ATR.

All of the risk calculations are as of Friday's close. We've listed the number of average true ranges we're using. You should be able to calculate ATR on most any trading platform. If not, you can use the figures above as approximations in your money management routines.

The first of these trades won't trigger until Sunday night, at the earliest. I'll be sending out a full worksheet on each of the trades so that you can see the year-by-year performance ahead of the trade's execution.

Remember, you can subscribe for $35 per month before we officially launch this product with new branding...and pricing.