The first trade for March is in the May #11 sugar futures contract. This market recently broke critical support at $.13 per/lb on bearish fundamental news. Now, we expect seasonal weakness to force this market lower, ahead of the March 8th, USDA Supply and Demand report and on through the Prospective Plantings report on March 29th, extending losses to the lowest prices in ten years.

First, we expect to enter sometime between Friday and Tuesday. We'll send an email when it's time (sent 3/5). The # 11 sugar contract trades through our platform as "ISB." May's month code is, "K." Initial margin is just under $1050 per contract and every tick is $11.20.

Second, we'll be using a dynamic stop with this model set to twice the May sugar's average true range. The multiple will remain the same but, the price and its proximity to the market will vary, daily. We'll update the protective buy stop price nightly.

Third, we'll hold the trade for about three weeks. Again, we'll send an email when it's time to exit.

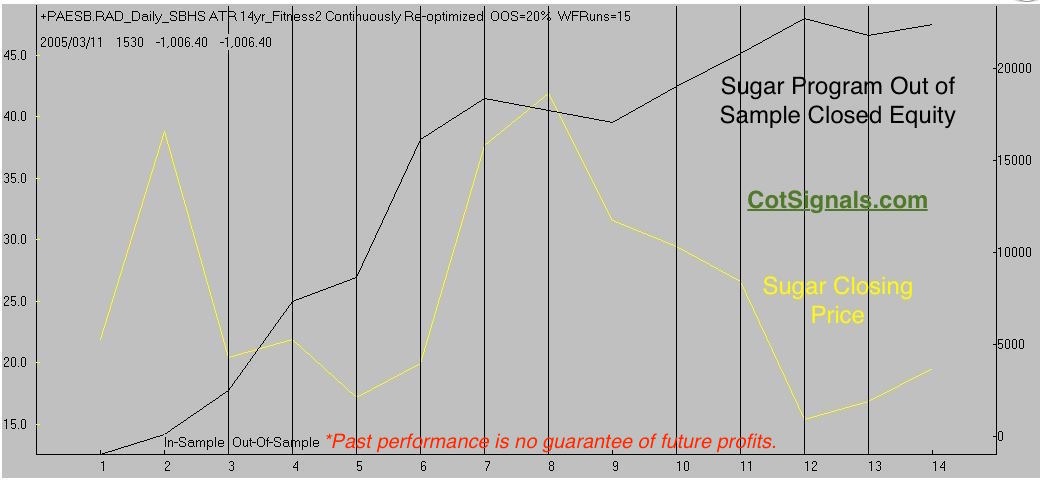

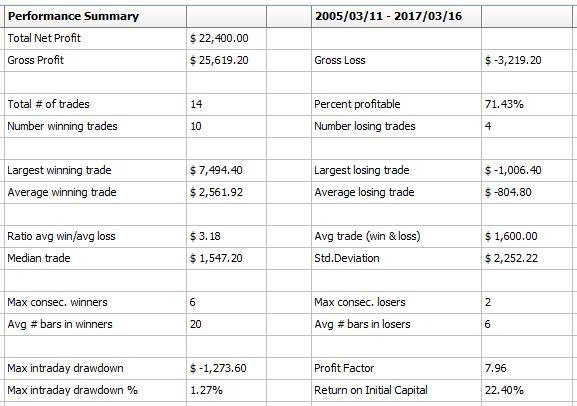

Now, let's get to the stats.

The recently depressed price of sugar provides an excellent example of the pros and cons of using dynamic vs. static stop loss orders. This time, in favor of dynamic stops, because volatility isn't linear. The average true range of the May 2018 sugar contract over the last year is about 30 points. This includes October of 2016 when this contract was trading at $.20 per/lb. Typically, a static stop for sugar would be near 5% of the entry price. A 5% stop would yield risk of $1,120 at the highs but, only $728 at $.13 per/lb. Meanwhile, the dynamic version of our stop looks only at recent market behavior, The May '18 contract was trading this time last year, and the market was still near $.19 per/lb. The dynamic model produced protective stop values from 18-108 points away for the 2017 trade. Recent readings suggest our protective stop will vary between 32-120 points away from the market's close. One of the downsides to percentage based stops is that they tend to give a market too much room at high prices while not providing sufficient breathing room at lower prices.

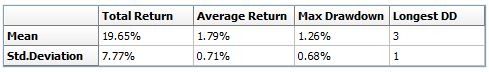

As always, we'll close with the Monte Carlo analysis.

The average trade of nearly $1,800 converts to approximately 160 points of market movement. May sugar has just broken the $.13 per/lb support. Will we see $.114 in the next three weeks?

Sign up for Seasonal Analysis - $35 per/mo. Crude oil, unleaded and Kansas City wheat yet to come this month.