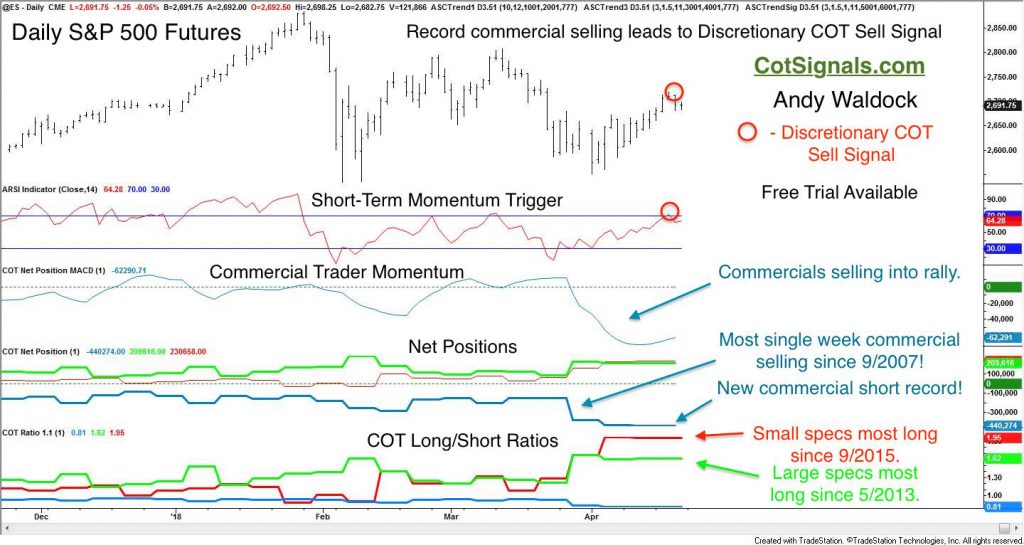

Our Discretionary Commitment of Traders strategy has just issued a sell signal in the June S&P 500 futures based on the record amounts of commercial selling we've seen during April's bounce.

Read - Commercial Traders Aggressively Selling S&P 500 Futures for the background.

We've posted the updated, daily chart to illustrate the mechanics behind this trade as well as the short sale signal from our worksheet, below.

We only take trades in the direction the commercial traders are forecasting through their actions in the Commodity Trading Commission's (CFTC) weekly Commitment of Traders report. My research has shown that conflicts between the commercial and speculative traders typically resolves in favor of the commercial traders. This makes sense since the commercial traders are, collectively, the most influential and most inter-connected players within any given market. I've done the boards of directors research to prove it. The recent record selling pressure that has been applied by the commercial traders has put us on the lookout for short selling opportunities.

Commercial traders have deep pockets and typically employ a reverse Martingale, pyramiding approach. They buy more as prices fall and sell more as prices rise. They're range traders who have the pockets to play exceptionally wide ranges over the longer-term.

We lean on the commercial traders' actions while decreasing the risk to a manageable level for retail and professional traders. For example, while we were aware of the recent short selling by the commercial traders, we've been unable to execute short sales because the risk to reward metrics simply weren't there. April's rally has put us in a much better position to sell the market, driving the S&P 500 into overbought territory on our short-term momentum trigger.

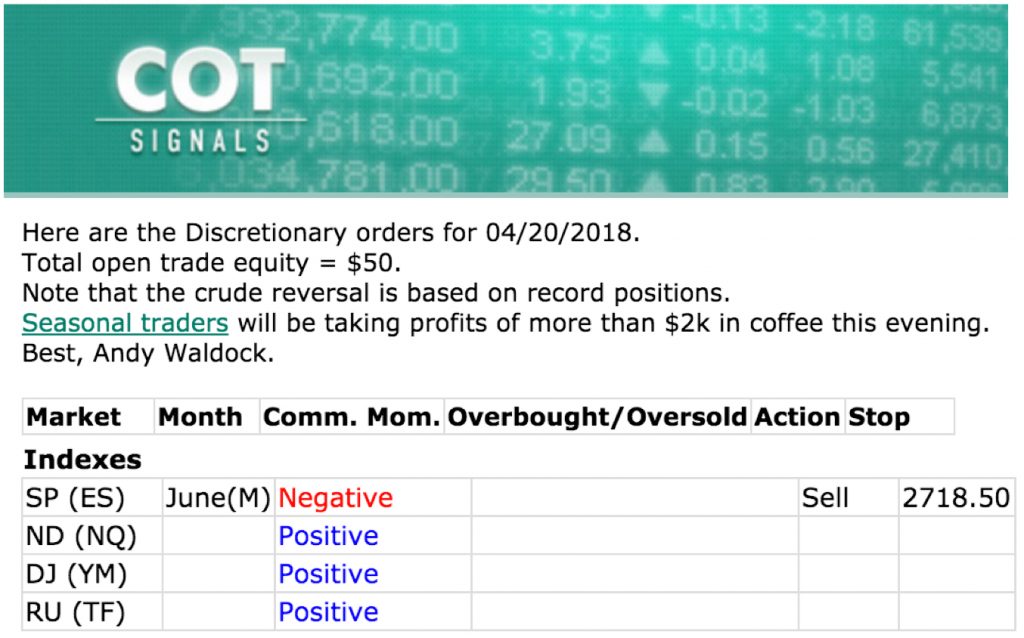

Yesterday's actions provided the reversal necessary to generate the short signal. The email we sent last night shows that commercial trader momentum is negative and we're placing a short trade in line with commercial traders' momentum, in the June S&P 500 contract. Equally important, once the reversal has been generated, we use the corresponding swing high or, low to place a protective stop loss order. In this case, we'll place a buy stop at 2718.50 in the June contract to protect the position.

The COT report is a big part of all of our models, and the Discretionary COT signals are the most sensitive of the three commodity trading strategies we've developed. The Discretionary signals typically run 3-5 business days. This is a mean reversion, swing trading technique. However, the magnitude of the current position imbalance between the speculators and the commercial traders strongly suggests something more substantial may be afoot.