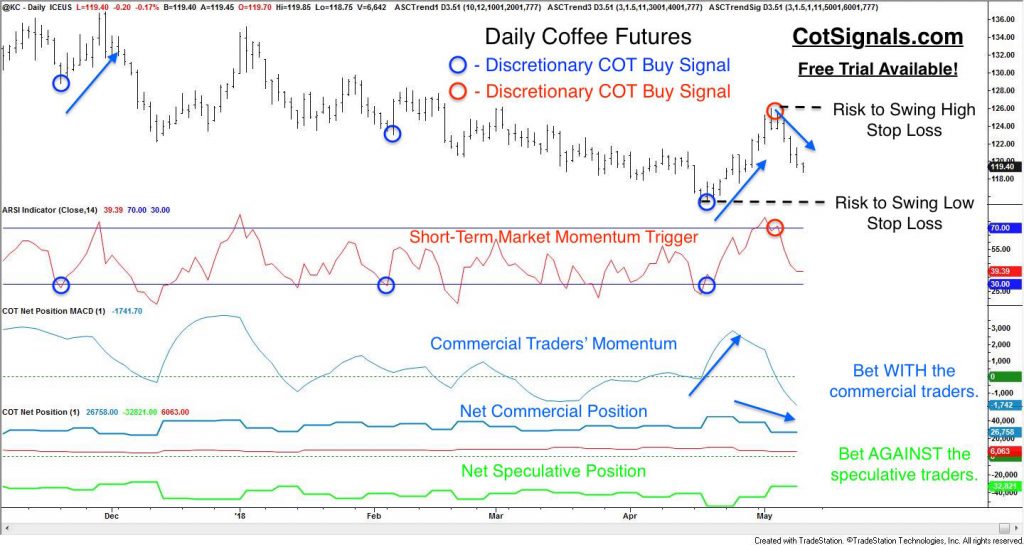

Coffee has been in a downward trend since November of 2016. Therefore, it's no wonder that coffee growers have been keen to sell their expected forward production on any rally in prices. Coffee producers have now been sellers for three straight weeks as coffee has climbed nearly 10% since mid-April, and their selling generated a Discretionary COT Signals short sale using the setup, below. We follow the commercial traders' actions because these are the people tied directly to the fundamental price discovery of any given market. Their collective decisions come from the world's biggest boardrooms. It's safe to assume that their selling ahead of seasonal weakness, as predicted by multiple seasonal models, is no mere coincidence. The combination of producer selling and seasonal weakness bodes poorly for coffee prices through month-end.

This is a pattern-based swing-trading methodology that I've been using for 15+ years. This is also the most sensitive of our trading approaches. The basis for the profitability of this method lies in the fact that markets are rarely trending yet, the speculators are always in search of the next trend. The market pulls an about-face when the trend fails to materialize, and the speculators are forced to take their losses as the market returns from whence it came.

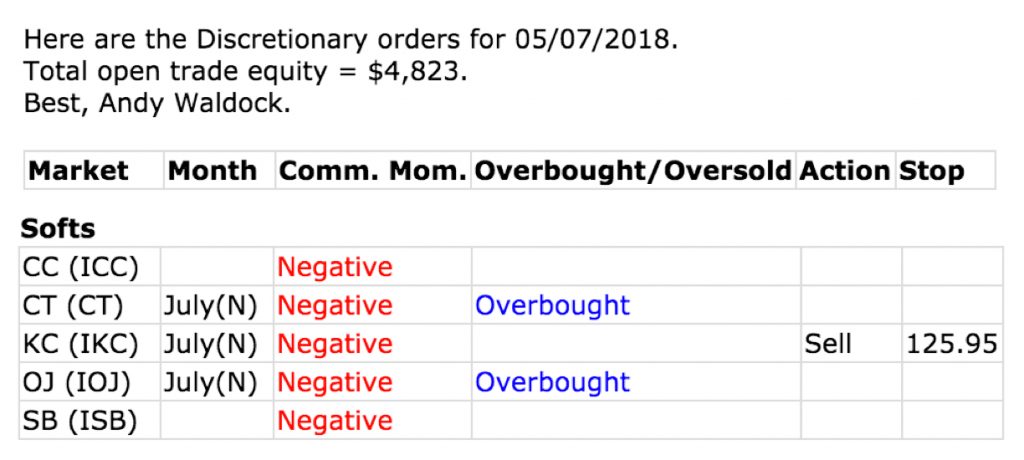

You'll see our nightly format, below. We use the same setup for all major US commodity markets.

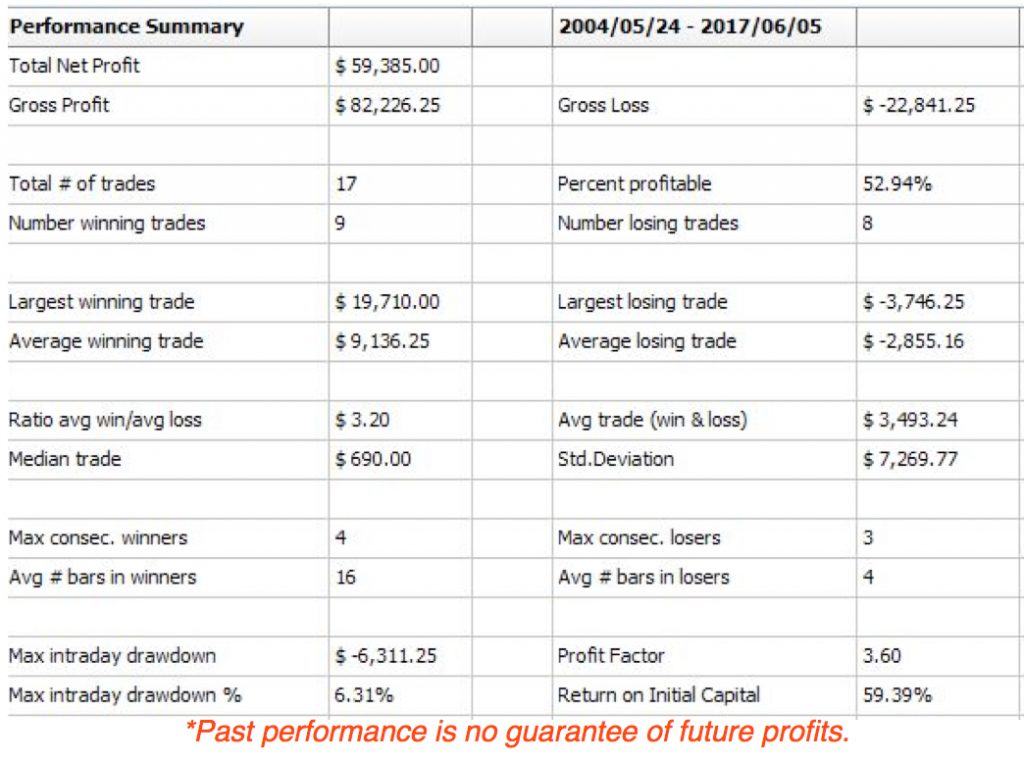

Moving to the seasonal details, we'll be employing a percentage based maximum risk of 3% above the entry price. If the market moves our way, we'll update the stop-loss order with a volatility based exit. Our subscribers will have the appropriate instructions emailed nightly. Finally, before moving to the performance metrics of this fifteen-year model, we'll note the winning percentage is lower than our seasonal average but, the win/loss ratio more than makes up for it. Remember, I'm not selling anything I don't trade.

Trade Details:

July coffee futures margin - $2,310.

Risk - Initially, we'll place a protective buy stop 3% above the opening price the night we enter the trade. If the trade becomes profitable, we'll begin to lock it in with a trailing stop. The max risk for the trade with July coffee futures at 119.00 is 3.57 points or, approximately $1,340 per contract plus brokerage commissions and fees. We are also a guaranteed introducing broker and can trade these strategies for your commodity futures account.

Reward - The report below states a median trade of $690. This means half the trades made more than this and half the trades made less, including all losses. This is a better representation of actual trading than simply looking at the average winning trade, which is more than $9,000 because the mean is skewed by the largest winning trade of nearly $20k and accounts for one-third of the out of sample returns.

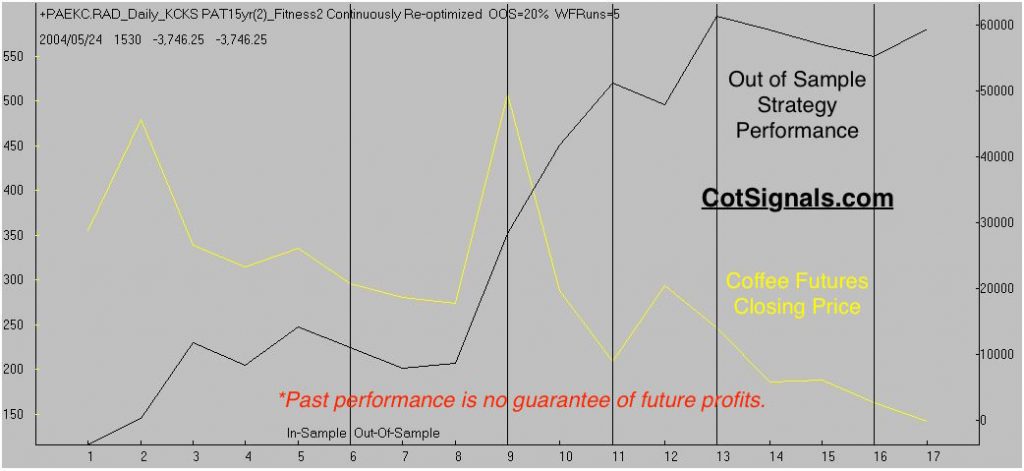

I always include an out of sample equity curve overlaid with the underlying prices of the commodity we're trading. It's important to see the correlation between a seasonal strategy's prediction and the requisite market action required to produce the expected results. I've been trading for 25 years, and two things still amaze me. One, the way commercial traders can step up and turn a market right at the high or, low. Two, the way seasonal forces can impact a market and find profitable pockets within a multi-year market move in the opposite direction.

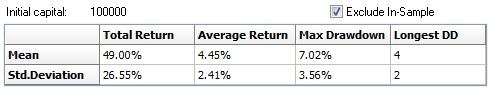

Finally, we close with Monte Carlo analysis. One of the difficulties with seasonal studies is limited data. We test the data using multiple out of sample windows and only compare out of sample results. If it wasn't predicted in advance, it doesn't count. Strict adherence to testing on blind data has allowed the algorithms to do a pretty good job of predicting the next window of opportunity within a given market. When these testing processes are sampled sufficiently, the results have fallen within the models' predictions as you can see by our seasonal results.

We'll be entering this trade by the end of the week. We'll also be trading hogs, cocoa and, the Canadian Dollar this month using the same core principles. Sign up to see our May trade plan and, trade along with me.