The March cotton futures tend to close the year strongly. We expect this market to move higher from here through year-end based on the growing commercial trader position and seasonal strength, which should create a bit of a saucer base and bottom.

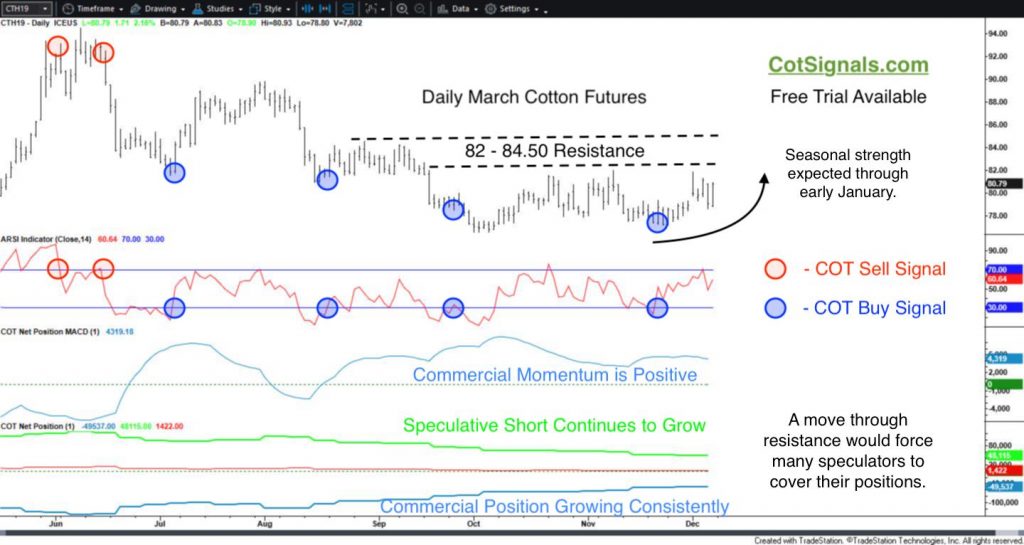

Beginning with our Commitment of Trader data analysis, you'll see on the chart below that commercial traders started buying cotton in mid-August, as the market declined. This is standard commercial behavior as they lay hedge their future supply prices in the futures market. Their buying suggests that they expect the recent decline to end, soon.

The commercial traders' actions are the exact opposite of the speculators. The speculative position is built upon trend following. Therefore, the speculative position grows as the trend matures. Unfortunately for speculators, markets are generally only trending about 20% of the time. We expect this to be another trend that fails to materialize as the commercial bid supports the market and forces some speculative short covering thus, driving the market higher.

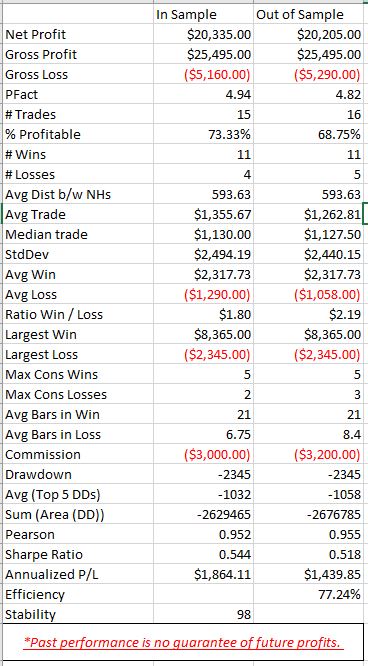

We'll be advising our seasonal subscribers to take a long position in the March cotton futures. You can get an idea for our expectations from the performance figures on the left. The model has generated a favorable winning percentage while still maintaining a handle on risk. We feel that our risk management is one of the unique components of our seasonal trading strategy. We'll be risking 5% from the opening price of our entry date. This is more than usual, but it's dictated by current market conditions. Five percent from the current price of $.8 per/lb will be approximately $2,000 per contract.

We have managed solid seasonal results through our first year of publication. We offer a free trial to the Discretionary COT Signals, as published in the first chart. The COT Signals method has no track record due to its discretionary nature. That is why we offer a free trial. The swings generated in the nightly email generally 3-5 trading sessions. If you're a mean reversion trader or, that guy sitting at the end of the table with the big stack of chips on the "Don't Pass" bar, this may be a robust tool for your arsenal of commodity trading strategies.

However, if you're a hands-off investor, we can trade the seasonal program on your behalf. This route ensures your orders are placed first...even ahead of mine.

Andy Waldock

info@cotsignals.com

866-990-0777